Competition-law specialists at Primerio have compiled the following snapshot of 2025.

Competition law enforcement across Africa continued its market trajectory of expansion throughout 2025, with early signals in 2026 enforcing a continent-wide shift towards more assertive, coordinated and policy-driven antitrust regulation. At both a national and regional level, authorities have increasingly moved beyond traditional enforcement and investigative tools.

A defining feature of 2025 has been the growing institutional confidence of African regulators. From the introduction and strengthening of regional regimes to the imposition of significant sanctions against multinational digital market players, African Antitrust enforcement bodies have demonstrated both technical capacity and willingness to ensure compliance with regional and national legislation. At the same time, legislative reform and increases in guidance notes and clarificatory tools signal an increasingly sophisticated regulatory environment, however, one which is more complex for multi-jurisdictional transactional and conduct risk.

This Snapshot spans the key developments we have previously reported on across Southern Africa, the Common Market for Eastern and Southern Africa (“COMESA”), the Economic Community of West African States (“ECOWAS”) and the East African Community (“EAC”), highlighting recent enforcement trends, institutional milestones and new policy innovations that shaped 2025 and which we anticipate will define the African Antitrust landscape as we move further into 2026.

Southern Africa

In South Africa, 2025 and early 2026 have been characterised by increasing interventions in mergers as well as continued use of exemptions and industrial policy.

Digital platform regulation was a defining theme in 2025. The South African Competition Tribunal’s (“SACT”) interim relief order in the Lottoland / Google Ads case signalled a willingness to ensure enforcement over exclusionary conduct in online advertising. This assertiveness was echoed in the GovChat v Meta ruling, where the SACT’s approach to platform access and data inoperability signalled the intention to rest the outer bounds of abuse of dominance enforcement against global big-tech firms.

In parallel, South Africa saw emerging scrutiny from the consumer protection angle, with the South African National Consumer Commission probing e-commerce platforms’ data practices and compliance frameworks, highlighting the convergence between competition and consumer protection enforcement in digital markets.

The South African Competition Commission’s (“SACC”) media and digital platforms market inquiry outcomes, as well as the Google’s agreement to pay ZAR 688 million to South African media, have further illustrated how negotiated remedies and sectoral interventions are being deployed to rebalance digital value chains.

Exemptions and block exemptions have remained a central tool available to parties in South Africa. The granting of Transnet’s 15-year exemption raised significant debate about the appropriate balance between enabling infrastructure coordination and preserving competitive neutrality. Subsequent developments in exemptions, including the block exemption in respect of Phase 2 of the Sugar Master Plan and corridor-based logistic exemptions, confirm that exemptions are being embedded as a long-term sector restructuring tool rather than temporary measures to allow coordination as well as a means to attain specific public interest and industrial policy goals.

Procedural and evidentiary developments have also shaped the landscape. The SACT’s decision granting absolution in the X-Moor tender cartel case clarified the evidentiary burden in collusive tendering prosecutions, reinforcing the need for robust inferential and documentary proof.

In relation to developments in merger control proceedings in South Africa, intervention dynamics were tested in Lewis Stores application to intervene in the merger between Pepkor Holdings Limited and Shoprite Holdings Limited. The South African Constitutional Court permitting Lewis’ intervention have raised much debate as to whether intervention by third parties frustrates and unduly delays the finalisation of merger hearings in South Africa.

The SACC had introduced a number of guidelines in relation to treatment of confidential information, as well as gatekeeper conduct with respect to pre-merger filing consultation processes, online intermediate platforms, notifications of internal restructures meeting the definition of mergers, and price-cost margin calculations. More recently, there have been proposed revisions to the SACC’s merger thresholds and filing fees, signalling a move towards greater ease in deal negotiation.

COMESA

2025 was a landmark year for both regulatory and enforcement developments in the COMESA region.

Most significantly, 2025 saw the introduction of the newly renamed ‘COMESA Competition and Consumer Commission” (“CCCC”) and the publication of the much anticipated COMESA Competition and Consumer Protection Regulations (2025). Early 2026 has also brought subsequent clarifications released by the CCCC with regard to its new suspensory merger regime in order to provide further insight into the CCCC’s approach in regulating mergers now brought to its attention.

The COMESA Court of Justice’s decision regarding the legality of safeguard measures imposed by Mauritius on edible oil imports from COMESA Member States demonstrated continued willingness of regional bodies policing activities of individual Member States.

Regional integration has been further reinforced through a number of cooperation initiatives, including formalised engagement between COMESA and the EAC on competition and consumer protection enforcement.

At Member State level, national competition regimes continue to interact dynamically with the regional system – this has been demonstrated by merger control retrospectives in Malawi, and regulatory developments in Zimbabwe. The Egyptian Competition Authority has, through recent guidance, also sought to provide further clarity with respect to its merger control regime and align with international best practice.

When considered alongside reflections on enforcement trajectory more broadly throughout the COMESA Common Market, the CCCC appears to be consolidating a far more assertive and procedurally sophisticated authority.

EAC

The operational launch of merger control marked a structural milestone for the East African Community Competition Authority (“EACCA”). The EACCA’s confirmation that it would begin receiving merger notifications from November 2025 introduced yet another operational regional authority on the African continent.

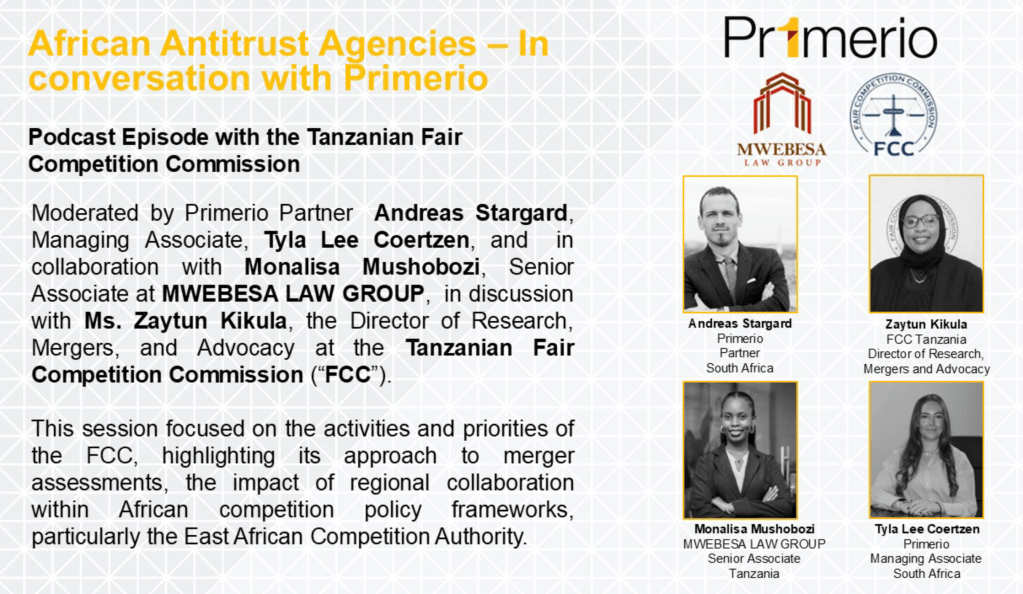

National enforcement has remained active alongside this regionalisation. Tanzania’s merger control developments and enforcement strategy signal a regulator seeking sharper investigative tools and clearer procedural pathways. Institutional cooperation is also deepening, as evidenced by alignment initiatives between the Tanzania Fair Competition Commission and the Zanzibar Fair Competition Commission, aimed at reducing jurisdictional fragmentation.

Kenya has also provided some of the region’s most visible enforcement signals. The upholding of cartel sanctions in the steel sector confirms judicial backing for robust cartel penalties. Leadership transitions at the Competition Authority of Kenya may also influence enforcement measures leading into the new year. More recently, the fine imposed in the Directline decision underscores the reputational and financial stakes attached to non-compliance with Kenya’s competition regime.

ECOWAS

Nigeria has been at the forefront of digital enforcement measures in Africa. The Nigerian Competition and Consumer Protection Tribunal’s landmark decision upholding the Federal Competition and Consumer Protection Commission’s $220 million fine on WhatsApp and Meta for discriminatory practices signals both the scale of sanctions now at play.

Regionally, the Economic Community of West African States Regional Competition Authority (“ECRA”) merger control regime gained operational depth in 2025, having been launched in late 2024. Early analysis framed the regime as a foundational shift towards increased regional review, while subsequent approval decisions demonstrated increasing practical application and institutional learning.

Legislative reform also remains underway at Member State level. The Gambia’s draft competition bill reflects a move towards more proactive market inquiry and enforcement powers, suggesting that more novel African national regimes are evolving in tandem with regional frameworks.

Conclusion and Outlook for 2026

Across the African continent, several cross-cutting themes have emerged. First, in line with global antitrust enforcement, digital market investigations and enforcement remains a focus point. From South Africa’s media and digital platform market inquiries and exclusionary investigations to Nigeria’s abuse of dominance sanctions and COMESA’s recent investigation into Meta, it is apparent that African competition authorities are increasingly asserting jurisdiction over digital platforms. Second, exemptions and public interest tools, particularly in South Africa, are being normalised as structural industrial policy instruments.

Regionalisation is also accelerating. COMESA’s long-awaited regulatory overhaul, the introduction and operationalisation of the EACCA’s merger regime and ECOWAS’ expanding enforcement collectively point towards a multi-layered African merger control framework requiring often complex, parallel and overlapping multi-jurisdictional navigation. Institutional cooperation agreements and memorandums of understanding further reinforce this trajectory, suggesting more coordinated enforcement and increased risk of detection.

Looking ahead, we note three developments which merit close attention. First, the practical implementation of new regional regulations, specifically those of the CCCC in COMESA, will test capacity, compliance as well as appropriateness of new regulatory hurdles in the global M&A space. Hand in hand with these, overlapping regional bodies will likely lead to jurisdictional disputes. Second, Digital market remedies are likely to evolve. Finally, in line with recent developments elsewhere, the continued blending of competition, consumer protection, and industrial policy objectives suggest that African antitrust enforcement will remain uniquely pluralistic.