By Megan Armstrong

The COMESA Competition Commission (“CCC”), released its 2024 Annual Report on 23 July 2025, outlining a narrative of both increased institutional maturity and a growing assertiveness in market regulation. This, against a backdrop of economic turbulence such as regional inflationary pressures, tightened global credit conditions and slowing GDP growth in Member States, the CCC pressed forward, making notable strides in their enforcement, policy advocacy and institutional development.

M&A Activity and a shift in sectoral dynamics

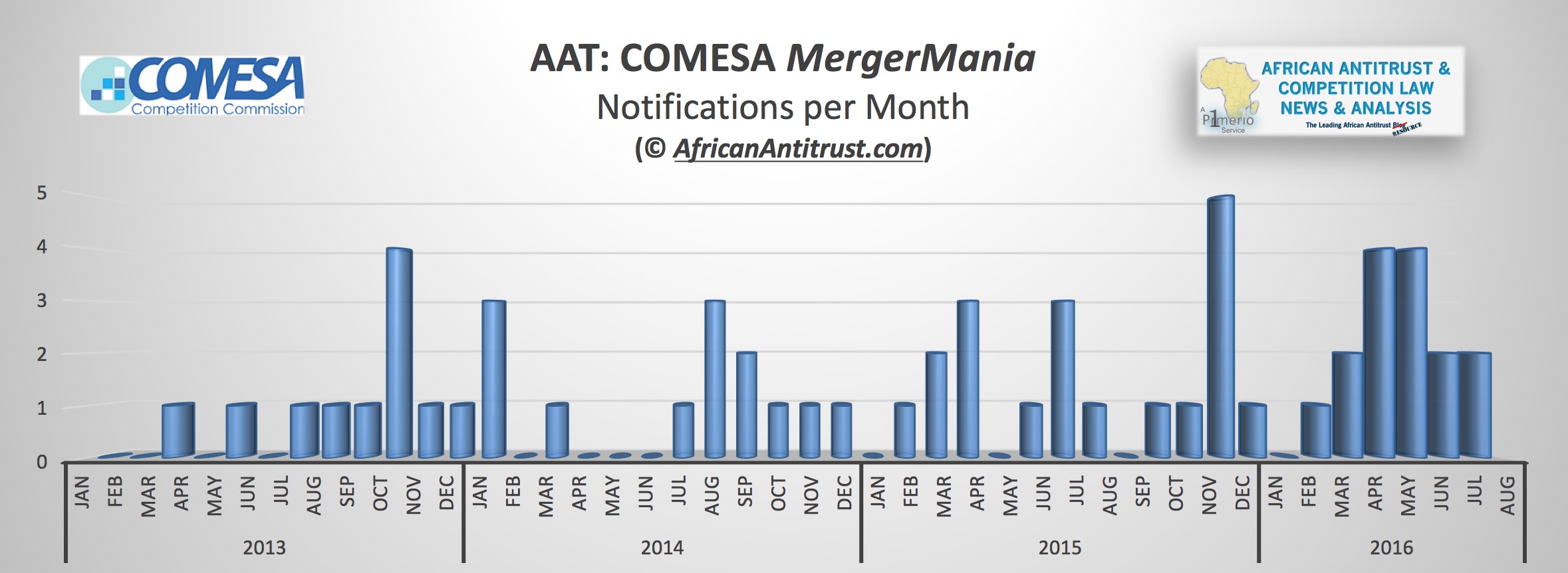

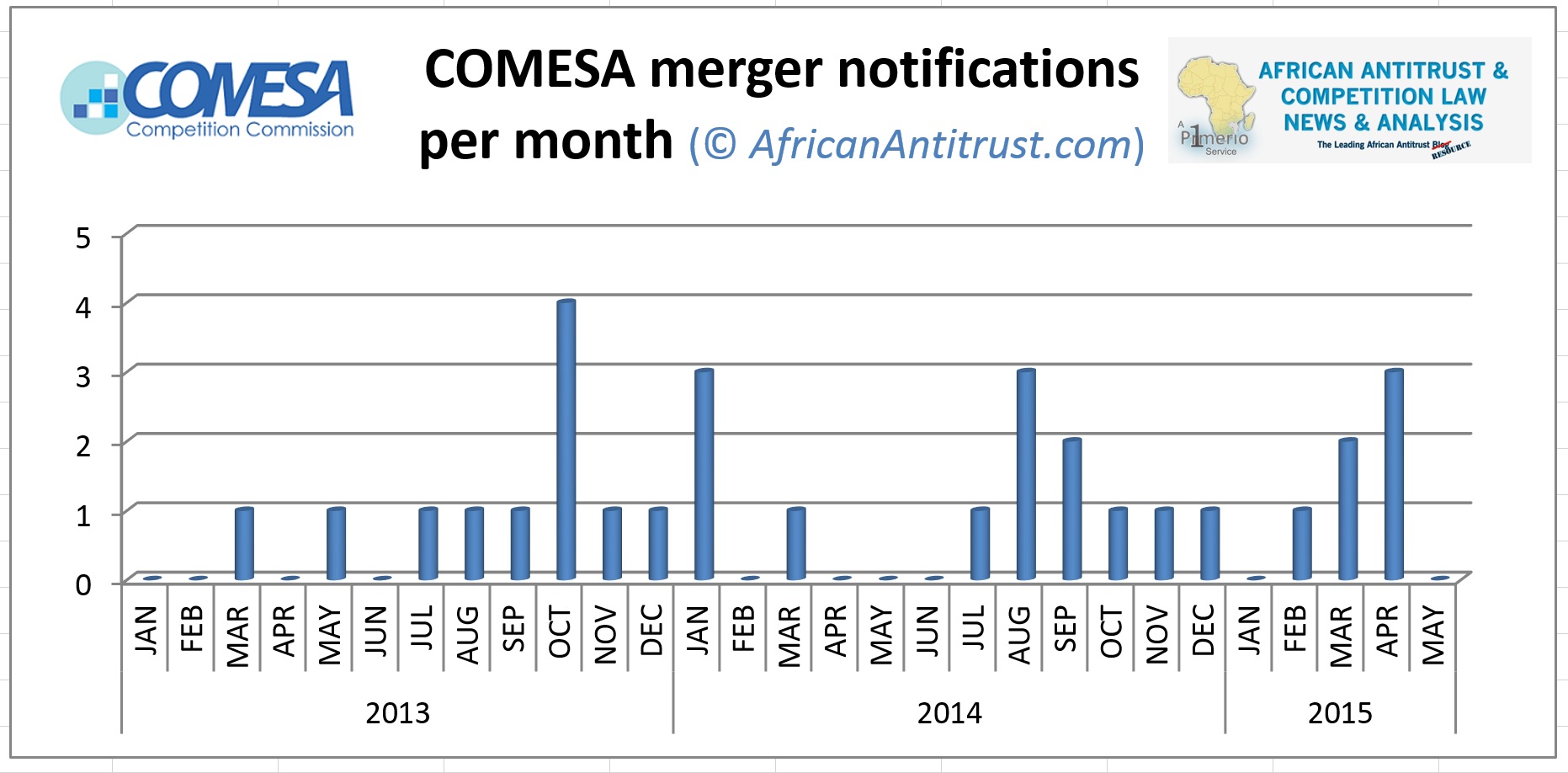

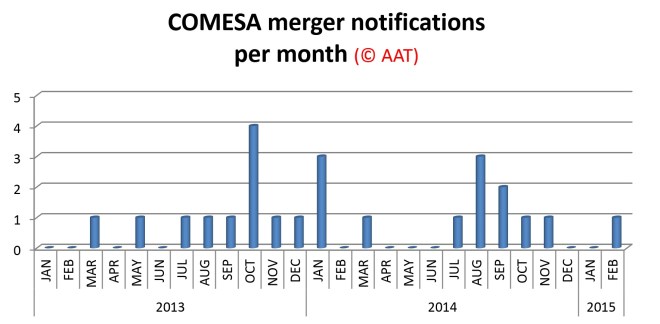

A notable metric from the year under review is the number of merger notifications, the CCC recorded receiving 56 transactions, a 47.4% increase from the previous year (2023). This spike may, in part, be a response to post-COVID19 economic restructurings and macroeconomic volatility prompting consolidation across various sectors. It is also likely that it points to a growing awareness among firms of their obligations to notify under the COMESA Competition Regulations, alongside the CCC’s increasing presence in regulatory enforcement within the region.

A large portion of these notified mergers in 2024 came from the banking and financial services sector, at 7 notified mergers, followed by energy and petroleum with 6 notified mergers, and ICT and agricultural sectors having 4 notified mergers each. Notably, each of these sectors can be linked to economic resilience and infrastructure development across the Member States. Countries like Kenya and Zambia showed the highest levels of enforcement with respect to mergers, affirming their roles as key economic nodes within the COMESA region.

The CCC continued to apply the subsidiarity principle in their merger assessments, deferring to national authorities where appropriate. With this, there were still 43 determinations finalised within stipulated time frames, unconditionally cleared with no mergers being blocked or subject to conditions. This contrasts with 2023, where four such interventions occurred. This unblemished record may suggest procedural compliance and benign effects, it does raise the question of whether these competitive harms are being sufficiently interrogated or whether transactions are being proactively structured to avoid scrutiny.

Restrictive Practices: Building a Hard Enforcement Reputation

Here, the CCC pursued 12 investigations in 2024, increased from 9 in 2023. These investigations touched sectors ranging from beverages, to wholesale and retail, ICT, pharmaceuticals and transport and logistics. The CCC’s increasing use of ex officio powers, particularly in the transport and non-alcoholic beverages sectors is noteworthy, reflecting a strategic pivot from a reactive enforcement regime to a more intelligence-led and proactive regime.

The CCC bolsters this enforcement strategy with an acknowledgement that behavioural change often requires more than deterrence. It maintains research and advocacy at its core focus for market engagements. The CCC’s involvement in collaboration with the African Market Observatory project in the food and agricultural sector highlights the market and policy failures that arise in these areas. This research has spurred dialogue at both national and international levels, including involvement from the OECD and International Competition Network.

Reform and Capacity Building

The CCC has initiated a long-overdue review of its legal framework, seeking to modernise its 2004 Regulations and Rules. These revised instruments, once adopted, are expected to cover emerging regulatory concerns, which includes climate change, and digital markets. These are areas where the intersection between competition and broader public policy goals are becoming more pronounced.

The CCC has scaled up technical assistance across the region, including providing support to legal reform processes in jurisdictions such as Eswatini, Egypt and Djibouti. The CCC also presented training for competition authority officials in Member States such as Comoros, Zimbabwe and Zambia. These capacity building efforts are critical for the CCC to realise its vision of a harmonised and integrated regional competition regime.

The Year Ahead: A Cartel Crackdown and Consumer-Centric Focus

Looking ahead to 2025, the CCC has signalled a decisive focus on cartel enforcement. There has been a growing recognition that undetected and entrenched cartel operations remain one of the most damaging forms of anti-competitive conduct in the Common Market, resulting in raised priced, limitations to innovation and a stifling of regional integration. The CCC intends to ramp up their detection tools, build cross-border enforcement partnerships, and enhance leniency and whistleblower frameworks. This is a complex undertaking, but does provide the potential to yield transformative results should it be executed effectively.

Alongside this, the CCC intends to intensify its efforts on the consumer protection front, particularly in those sectors that have been flagged through its market intelligence efforts. The digital economy is one such priority sector, the CCC has received anecdotal evidence of exploitative practices in this sector and is positioned to clarify its understanding of the competitive dynamics at play in this sector. Similarly, product safety in the fast-moving consumer goods sector is expected to receive closer scrutiny.

Conclusion

If 2024 was the year of consolidation, 2025 promises to be the year of forward momentum. The CCC has shifted its weight towards deeper enforcement, increased research and the implementation of a regulatory framework that has the ability to meet and address modern market realities. From cartel detection to digital market fairness and food sector resilience, the CCC has an ambitious agenda for the year ahead.

As regional integration efforts gather pace under the AfCFTA, the CCC’s role as a guardian of market fairness and consumer protection within Member States will only become more central. With this groundwork having been laid, it is time for the harder, but more rewarding task: “building markets that work for everyone”.