By Daniella de Canha and Megan Armstrong

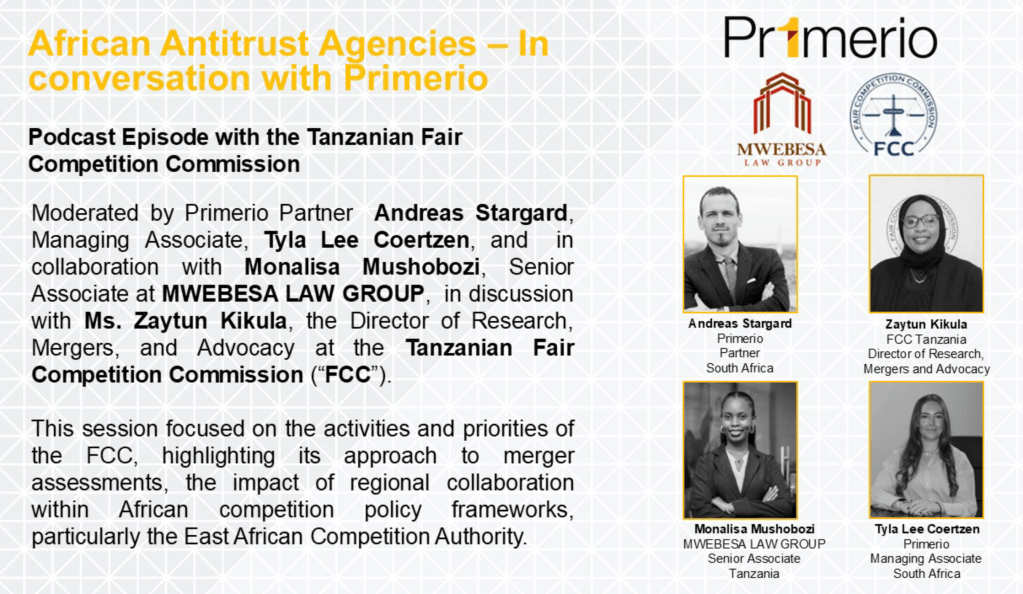

On 18 August 2025, pan-African competition-law boutique firm Primerio continued its “African Antitrust Agencies – In Conversation” series, casting a light on the Tanzanian Fair Competition Commission (“FCC”) in a dynamic exchange which analysed merger control practices, regional competition enforcement and regulatory reform. The discussion featured Director of Research, Mergers, and Advocacy at the FCC, Zaytun Kikula, in conversation with Primerio Director, Andreas Stargard, Primerio Associate Tyla Lee Coertzen, and Advocate at Mwebesa Law Group, Monalisa Mushobozi. You can watch a recording of this session here.

Ms. Kikula highlighted that the FCC’s focus has thus far mainly been on mergers, as well as investigating the dominance of abuse and cartels. She also points out that the FCC have been very active in its merger control regime, handling between 50 and 70 filings annually. Most of the notified transactions are smaller, spanning across sectors from telecommunication, finance, manufacturing, mining and insurance. Ms. Kikula stated that the recent amendments made to the Fair Competition Act 2024, have created a shift in merger reviews. Before these changes, the focus was only market share, whereas now mergers are being evaluated through a broader lens.

Monalisa noted an amendment to the Act now allows for a merger to be approved even it is strengthens the position of a dominant firm, provided the transaction yields a demonstratable public interest benefit. Ms. Kikula further explained that while the FCC has not received a transaction which triggers the above-mentioned amendment, notified transactions are subject to a 14-day notice period which invites commentary in order to ensure that the concerns of the public are adequately considered.

The FCC has encountered numerous instances of unnotified mergers, some voluntarily disclosing these transactions to the FCC, after the fact and others through investigation by the FCC. The FCC engages with these firms and lets them know that if they do not notify the Commission and proceed, this will constitute an offence which is punishable by a fine of between 5% and 10% annual turnover. Ms. Kikula mentioned the FCC assumes the role of a business facilitator and encourages settlements where the firms pay a filing fee as well as an additional settlement fee for instances of non-compliance. Filing fees are determined by the structure of the transaction, for instance, when dealing with a global entity the fees are calculated based on global turnover. When the transaction is domestic fees are calculated based on local turnover. She also pointed out the fact that this fee calculation is unconditionally governed by law and that there is no room for negotiation.

Monalisa mentioned that the law stipulates that the Commission has 60 days to approve the merger and inquired whether there have been cases where this timeframe has been shortened or extended. Ms. Kikula explained that non-complex merger reviews can extend between 30 to 45 days, however, in some cases can extend to 90 days. Noting that it may go up to 135 days, the statutory maximum. With regards to remedies, the FCC typically imposes behavioural conditions which are tailored to the specific sector involved.

The regional integration of competition law across Africa was a key theme which was highlighted. Andreas brought to the listeners attention that the East African Community Competition Authority (“EACC”) will be coming online in November of this year and will be open to receiving merger notifications. She further expressed that dual filings should be avoided in order to lessen confusion, emphasising the importance of confidentiality under a Memorandum of Understanding in order to protect information. Ms. Kikula discussed the two upcoming regulatory reforms which the FCC is in the process of introducing, with the first being a leniency program and the second being specific regulation for the assessment of dominance. She further noted that the threshold for market share has increased from 35% to 40%. This expansive discussion highlights the FCC’s ability to balance application with facilitation, making it a driving force in East African competition law.

November 15th, 2021

November 15th, 2021  Competition Commission

Competition Commission