Meet the “CCCC”: the 4th Estate Covers the 4th “C” of the COMESA Competition Commission During its Second Press Conference, and More

The second annual COMESA Competition Commission press conference, taking place in Livingstone, Zambia, revealed not only news, but also the extensive improvements to the agency being made, and information about ongoing market studies and case investigations. It was an opportunity to allow business journalists obtain a glimpse, if not indeed a full deep-dive overview, into the future of the triple-C – which is soon to be the “Quad-C”, in fact, as Dr. Mwemba, the head of the Commission, announced at today’s event. That is, the CCC will add a fourth “C” to its name, so as to include expressly the concept of Consumer protection. AAT notes that this is similar to several other national competition authorities, for example the Nigerian FCCPC or even the U.S. FTC, both of which also have an existing mandate covering consumer-protection issues, besides their jurisdiction over pure competition-law matters.

Name Change

Dr. Mwemba clarified that the now-express inclusion of this “4th C“ in the Commission’s name going forward is to highlight the fact that the Commission will enhance its focus on consumer-protection issues, and to ensure that the average consumer (as opposed to competition experts) in the COMESA region can better understand their rights and recourse to the CCC(C).

Public-Interest Factors

This renewed consumer-protection emphasis also goes hand-in-hand, AAT believes, with the increased importance of so-called “public-interest“ factors in the CCC’s merger analysis. Dr. Mwemba highlighted, by way of example, environmental factors and job creation numbers, as potential considerations to be taken into account by the Commission under the amended regulations, which will likely come into effect by December 2024.

New Competition Regulations

These newly amended COMESA Competition Regulations, which have been in the making since the May 2021 inception of the Commission’s efforts to revise the regional competition law, will culminate in the imminent clearance by the COMESA Legal Drafting committee, and ultimately (by the end of the year, we anticipate), its adoption by the regional committees of the COMEAS Attorneys General, of the Justice Ministers, and eventually the Council of Ministers of all 21 COMESA member states. Of course, as AAT has discussed before, these Regulation Amendments carry with them extensive revisions to antitrust law (e.g., the creation of a leniency programme for cartel offenders; the change-over to a suspensory merger notification regime; adding ‘transaction value’ to the concept of deal-notification thresholds, amending their definition from being purely asset- and revenue-based; and the creation of certain market-power presumptions based on share thresholds, just to name a few here).

Dr. Mwemba clarified in vivid terms that neither life nor law must be stagnant. Hence the import of the revision of the Regulations, which (in their current form) are by now two decades old. “The original 2004 COMESA law simply was no longer up to the task of helping the Commission to regulate modern markets as they stand in 2024 and beyond,” according to the CCC. Examples given by the senior staff present included the rapid rise of artificial intelligence, environmental changes to the economy, and digital platform evolution – all of which have proceeded faster than virtually all existing antitrust laws globally. The view of the executive of the Commission is that it is well-positioned to be at the forefront of adapting to these challenges of imminent change.

Merger Regulation

As both the past Director (Dr. George Lipimile) and the current CEO (Dr. Willard Mwemba) highlighted: the Commission does not exist to prohibit mergers. Instead, its purpose, from a merger-control perspective, is to ensure that any deals that may distort competitive markets is structured in such a way that the distortion ceases to exist or risk to the functioning of effective markets.

Answering one of the questions posed by africanantitrust.com, Dr. Mwemba confirmed that the Commission is continually engaged in ex post analysis and reviews of past mergers that were approved, sometimes with conditions, by the then-triple-C. In the ATC/Eaton Towers case, for example, it observed that the parties were found not to be complying with the obligations imposed by the contingent approval decision, therefore resulting in fines imposed by the CCC post-closing of the approved deal.

Beyond Mergers: Anti-Competitive Practices

The Commission has moved on from being a pure merger regulator long ago, however. This was a key theme throughout the multi-day conference. “We have moved on from just doing mergers, and have now been covering the terrible, always-hidden, and always-nefarious, anti-competitive practices found across the region for years,” says Dr. Mwemba about the more than 45 ACP matters the agency has handled so far. Case examples he gave in this respect include the CAF licensing of football rights (a veritable trilogy of matters at all levels of the intellectual property distribution chain regarding an important pastime in Africa, soccer).

Other instances of the CCC pursuing anti-competitive practices within the region include multiple investigations into the beer and alcoholic beverage markets, and a now concluded case against Uber (resulting in significant changes to the ride-sharing company’s contract terms in the COMESA region, namely removing a denial of vicarious liability clause, changing the choice of law provision from the Netherlands to local jurisdictions in COMESA, as well as changing the pricing and termination of services provisions of the contract of adhesion that Uber utilizes in its app.). Finally, the agency is deeply engaged in ongoing agricultural and food price studies, which will likely yield further enforcement actions going forward, in the words of the CCC.

Closing Thoughts: Due Process, Procedural Rights, and Deepening Collaboration with NCAs

Even though one of the identified CAF cases remains pending on appeal, Dr. Mwemba said that the Commission welcomes the parties’ exercise of their due process rights, noting that the CID review and appellate process provide valuable insights and that everyone stands to gain by the recognition and exercise of such due process under the rules and the law. Indeed, appeals have increased from just 1 in 2023 to 3 in 2024. The Commission also provided statistics on the collaboration it engages in with national competition authorities, including capacity building in Mauritius, the Democratic Republic of Congo, Uganda, and other member states. Finally, the statistics provided for the past 11 years show the transformation of the early period (which AAT had initially covered graphically for several years with its informal merger-stats analysis, now long-abandoned due to the CCC’s improved transparency and web presence): The CCC has handled over 430 merger reviews and more than 45 anti-competitive practice investigations.

Ms. Weeks-Brown noted the rise of pan-African (vs. purely domestic) banks, observing the added benefit of improved competition, as well as the steady rise of fintech on the continent. The latter is especially important as the continent is still

Ms. Weeks-Brown noted the rise of pan-African (vs. purely domestic) banks, observing the added benefit of improved competition, as well as the steady rise of fintech on the continent. The latter is especially important as the continent is still

The event’s tag line is “Benefits to Business.” Especially now, with the African continent sporting over 400 companies with over $500m in annual revenues, the topic of antitrust regulation in Africa is more pertinent than ever, according to the COMESA Competition Commission (CCC).

The event’s tag line is “Benefits to Business.” Especially now, with the African continent sporting over 400 companies with over $500m in annual revenues, the topic of antitrust regulation in Africa is more pertinent than ever, according to the COMESA Competition Commission (CCC).

Media

Media Speakers include a crème de la crème of East African government antitrust enforcement, including the CCC’s own Willard Mwemba (head of M&A), the CCC’s Director Dr. George Lipimile, and the Director and CEO of the Competition Authority of Kenya, Francis Wang’ombe Kariuki. Topics will include news on the rather well-developed area of of mergerenforcement, regional integration & competition policy, as well as the concept of antitrust enforcement by the CCC as to restrictive business practices, an area that has been thus far

Speakers include a crème de la crème of East African government antitrust enforcement, including the CCC’s own Willard Mwemba (head of M&A), the CCC’s Director Dr. George Lipimile, and the Director and CEO of the Competition Authority of Kenya, Francis Wang’ombe Kariuki. Topics will include news on the rather well-developed area of of mergerenforcement, regional integration & competition policy, as well as the concept of antitrust enforcement by the CCC as to restrictive business practices, an area that has been thus far

The second event, also held in Nairobi, will shift its focus both in terms of attendees and messaging: It is the CCC’s first-ever competition-law sensitization workshop for the Business Community, to take place on Wednesday. It is, arguably, even more topical than the former, given that the target audience of this workshop are the corporate actors at whom the competition legislation is aimed — invited are not only practicing attorneys, but also Managing Directors, CEOs, company secretaries, and board members of corporations. It is this audience that, in essence, conducts the type of Mergers & Acquisitions and (in some instances) restrictive, anti-competitive business conduct that falls under the jurisdiction of Messrs. Lipimile, Mwemba, and Kariuki as well as their other domestic African counterparts in the region.

The second event, also held in Nairobi, will shift its focus both in terms of attendees and messaging: It is the CCC’s first-ever competition-law sensitization workshop for the Business Community, to take place on Wednesday. It is, arguably, even more topical than the former, given that the target audience of this workshop are the corporate actors at whom the competition legislation is aimed — invited are not only practicing attorneys, but also Managing Directors, CEOs, company secretaries, and board members of corporations. It is this audience that, in essence, conducts the type of Mergers & Acquisitions and (in some instances) restrictive, anti-competitive business conduct that falls under the jurisdiction of Messrs. Lipimile, Mwemba, and Kariuki as well as their other domestic African counterparts in the region.

As Mr. Mwemba rightly pointed out, most transactions “do not raise competition concerns” and those that do can be and often are resolved via constructive discussions and, in some cases, undertakings by the affected companies. In addition, the CCC follows international best practices such as engaging in pre-merger notification talks with the parties, as well as follow-ups with stakeholders in the affected jurisdictions.

As Mr. Mwemba rightly pointed out, most transactions “do not raise competition concerns” and those that do can be and often are resolved via constructive discussions and, in some cases, undertakings by the affected companies. In addition, the CCC follows international best practices such as engaging in pre-merger notification talks with the parties, as well as follow-ups with stakeholders in the affected jurisdictions.

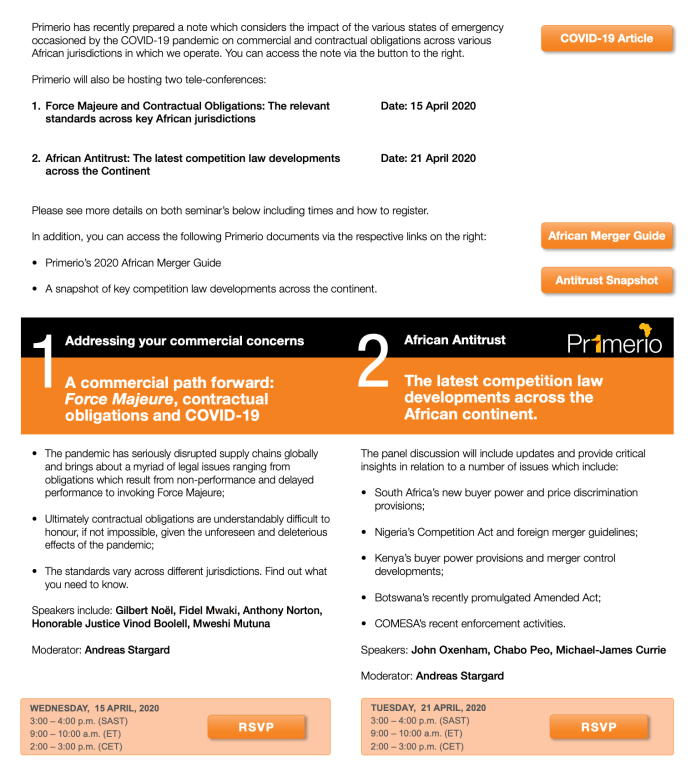

Primerio is hosting two telephone conferences: